2025 Tax Credits Return Form 2025. Tax credits and deductions for individuals. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for.

Instructions to help you complete the application for refund of franking credits for individuals 2025 (nat 4105). And here’s the very best part:

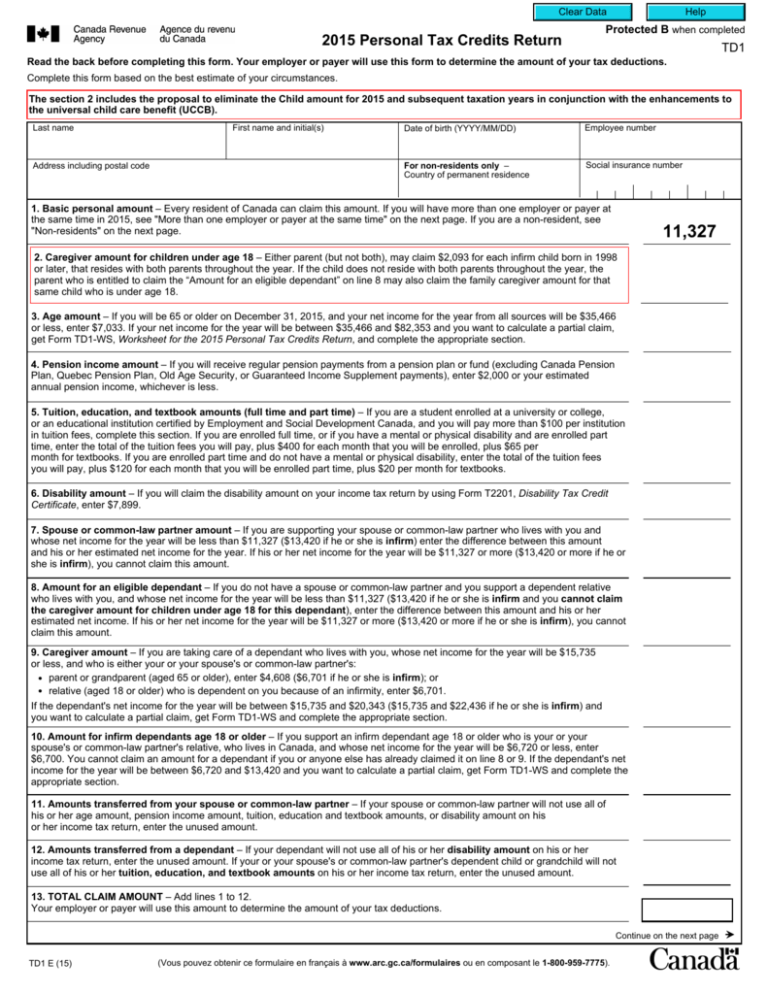

Fillable Online 2025 Personal Tax Credits Return Fax Email Print, You can claim credits and deductions when you file your tax return to lower your tax.

2025 Tax Credits Return Form Kitty Michele, The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for.

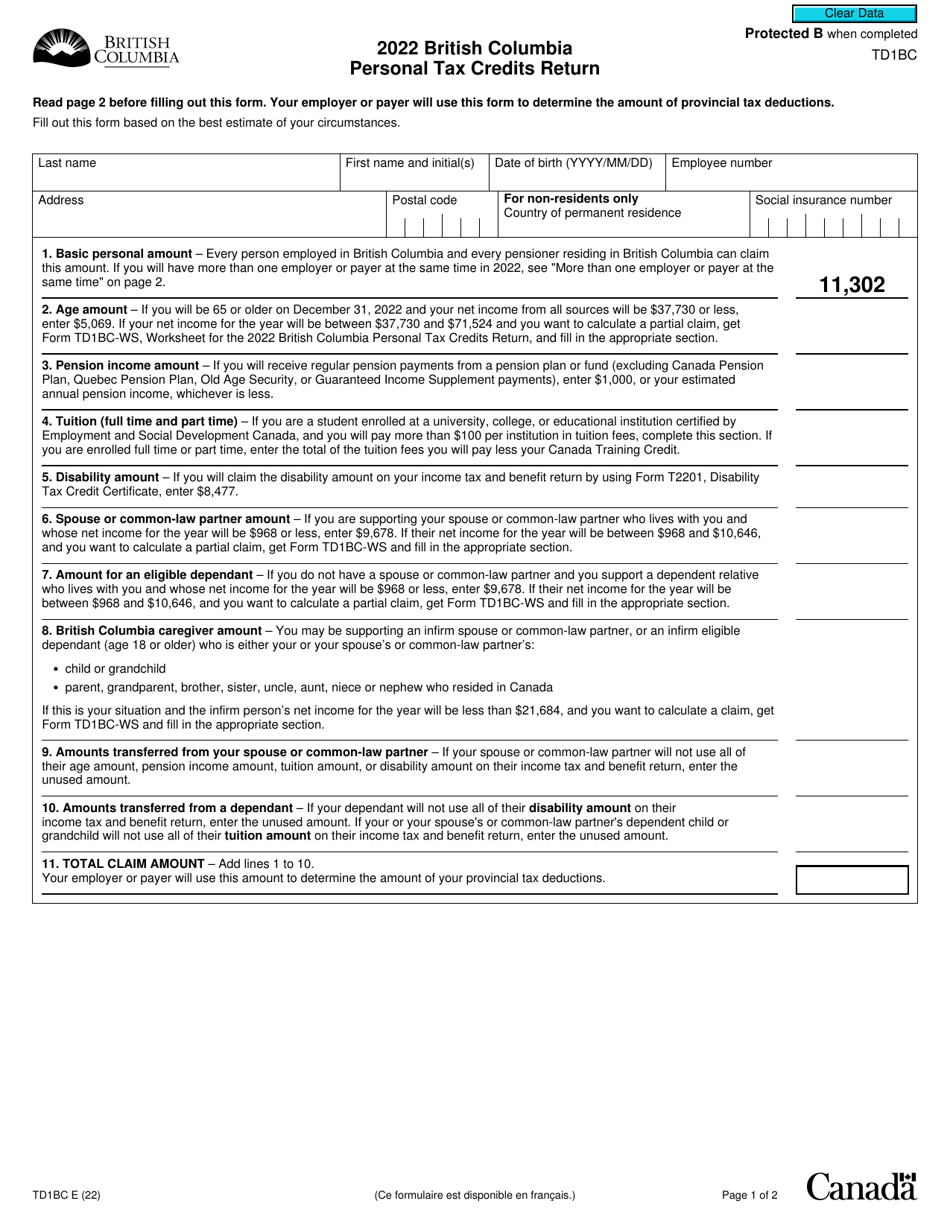

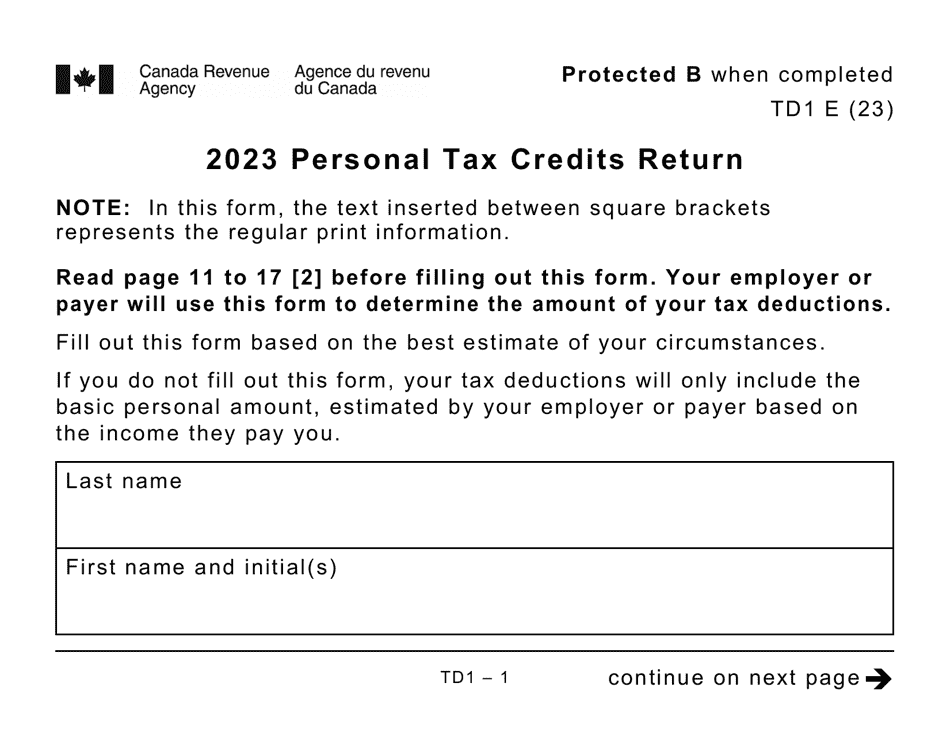

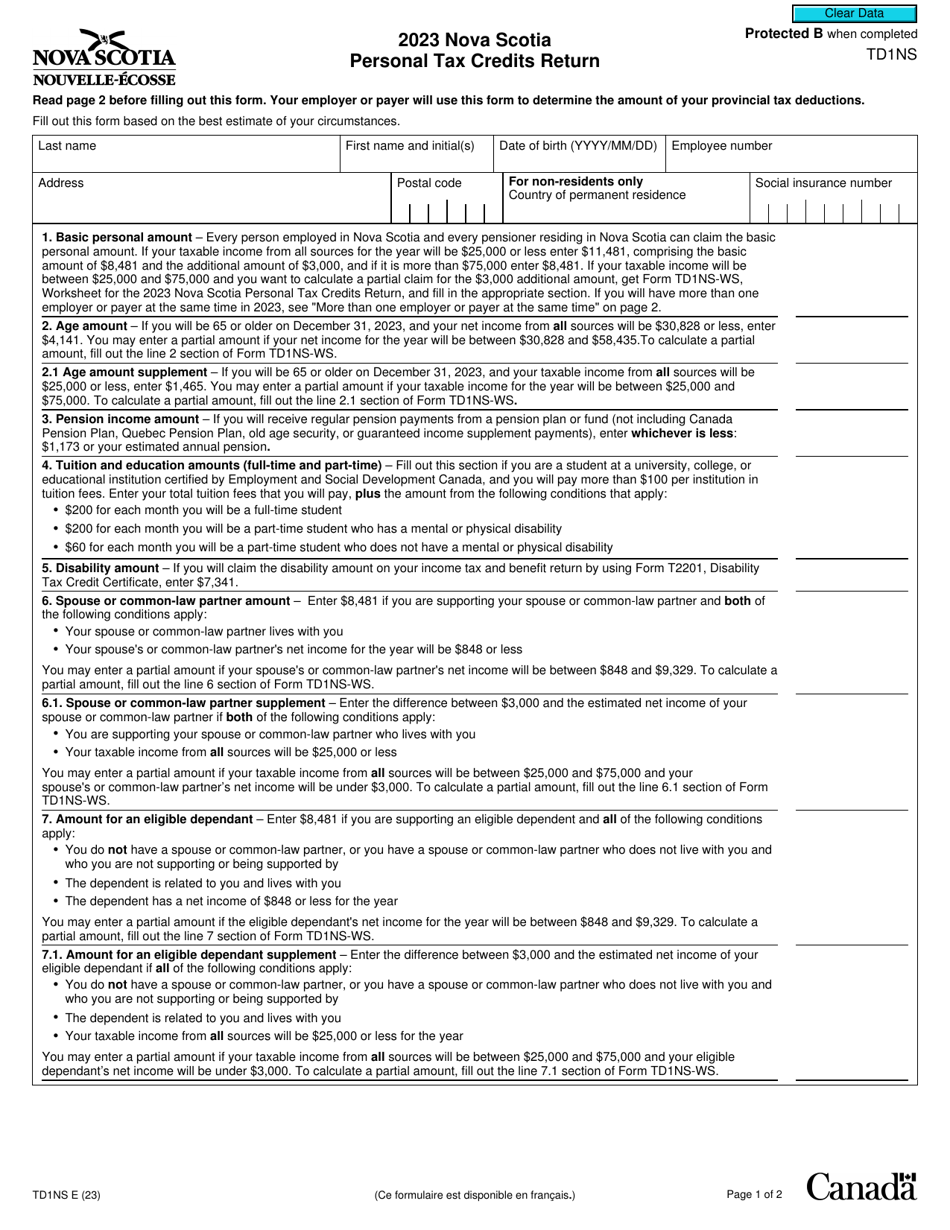

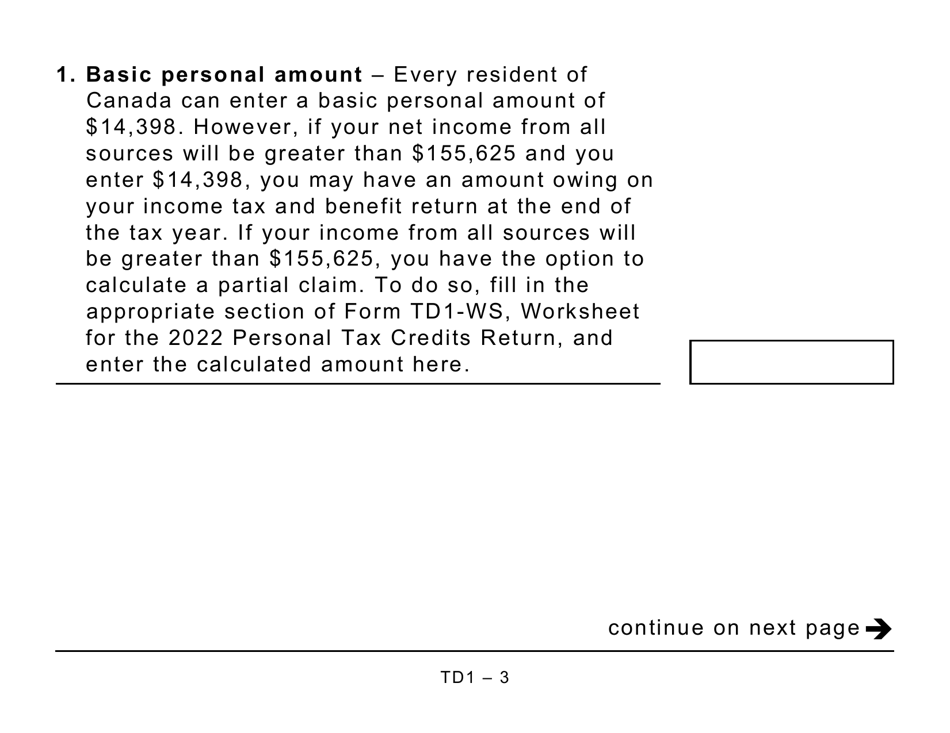

2025 Tax Credits Return Form Kitty Michele, In this video, i will walk you through the federal td1 personal tax credits return form for the year 2025 in canada.

2025 Personal Tax Credits Return Form Pdf Kass Sarene, In this video, i will walk you through the federal td1 personal tax credits return form for the year 2025 in canada.

2025 Personal Tax Credits Return Form Ontario Gerti Hildagarde, Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,705 in 2025 without paying any federal tax, and can earn anywhere from.

2025 Personal Tax Credits Return Form Canada Norah Annelise, Td1 forms for 2025 for pay received on january 1, 2025 or later.

Federal Tax Forms 2025 Dyann Grissel, Td1 forms for 2025 for pay received on january 1, 2025 or later.

How To Fill TD1 2025 Personal Tax Credits Return Form Federal YouTube, Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,705 in 2025 without paying any federal tax, and can earn anywhere from.