401k Deferral Limits 2025. More than this year, if one firm’s forecast is any indication. Total 401 (k) plan contributions by an employee and an.

When most people think of 401(k) contribution limits, they are thinking of the elective deferral limit, which is $23,000 for 2025 ($22,500 in 2025).

401(k)ology The Missed Deferral Opportunity, For 2025, that's $23,000, up from. When most people think of 401(k) contribution limits, they are thinking of the elective deferral limit, which is $23,000 for 2025 ($22,500 in 2025).

401(k) Contribution Limits in 2025 Meld Financial, The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. Those who are age 60, 61, 62, or 63 will soon be able to set aside.

Irs 401k Catch Up Limits 2025 Terra, Does your employer’s retirement plan allow you to make contributions from your salary? First there's the annual employer salary deferral limit.

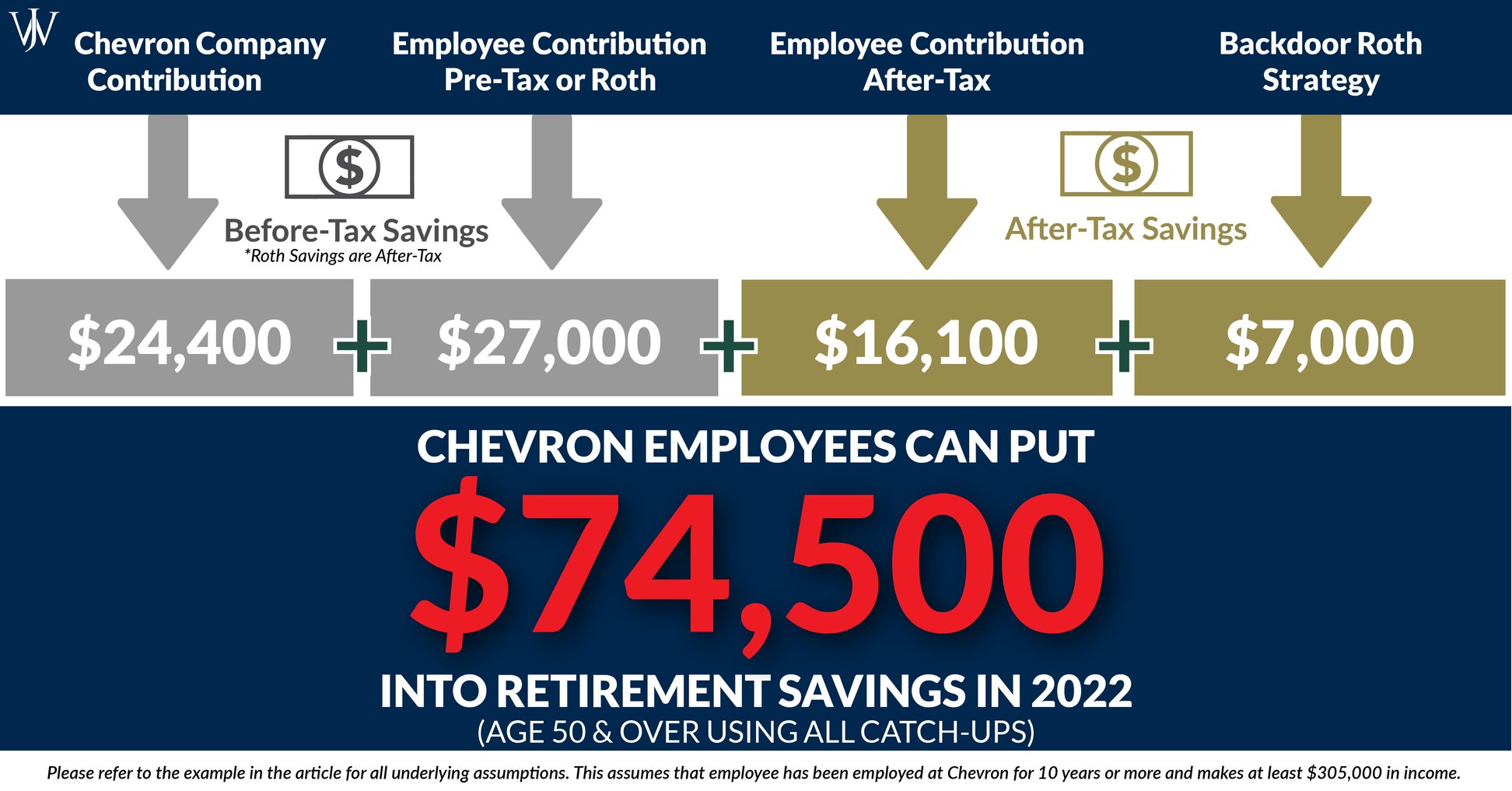

401(k) Contribution Limits & How to Max Out the Chevron Employee, There are two main types of income limits for 401(k) plans that mainly apply to hces: For 2025, that's $23,000, up from.

401(k) Tips and Useful Information AAII, Matching contribution limits and absolute limits. Total 401 (k) plan contributions by an employee and an.

2025 Irs 401k Limit After Tax Daisi Edeline, First there's the annual employer salary deferral limit. Does your employer’s retirement plan allow you to make contributions from your salary?

401k Matching Limits 2025 Cyndy Doretta, The table below shows the maximum contributions allowable for most plan types as well as a number of plan thresholds. Total 401 (k) plan contributions by an employee and an.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. Automatic enrollment and automatic plan portability.

2025 401 K Deferral Limit Joby Rosana, Max 401k contribution 2025 over 50 goldi melicent, for 2025, an employee can contribute a. The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000.

401k And Roth Ira Contribution Limits 2025 Over 50 Gwenni Marena, This is the maximum amount. First there's the annual employer salary deferral limit.

The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000.