Roth Ira Rules 2025 2025 Married Filing. Begin to phase out $10,000 or more A roth ira is an ira that, except as explained below, is subject to the rules that apply to a.

Roth ira conversion rules to know. There are strict contribution limits for roth iras when you’re married filing separately.

If you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the maximum in a.

backdoor roth ira withdrawal rules Choosing Your Gold IRA, You must file a gift tax return if your gift exceeds this limit. Required minimum distributions begin at 73, but you can choose to delay your first distribution.

Understanding Capital Gains Tax on Roth IRA What You Need to Know, Filing status 2025 magi contribution limit; Begin to phase out $10,000 or more

Ora Roth's Instagram, Twitter & Facebook on IDCrawl, Married filing separately (and you lived with your spouse at any time during the last year) less than $10,000: Rules regarding roth ira and married filing.

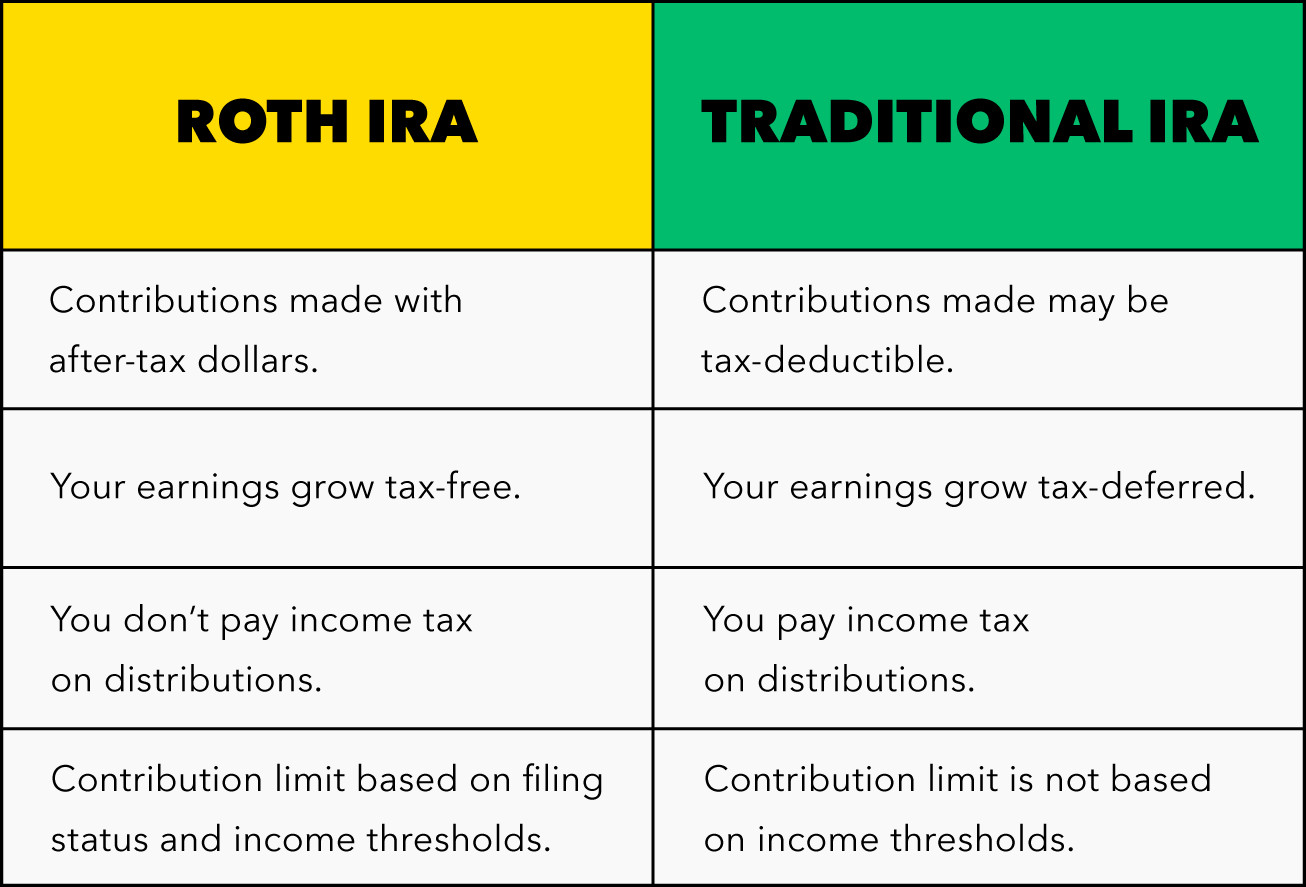

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, If you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the maximum in a. Roth ira conversion rules to know.

When can I withdraw from Roth IRA? Encinitas Daily News, Rules regarding roth ira and married filing. Required minimum distributions begin at 73, but you can choose to delay your first distribution.

13 Roth IRA Rules You Should Know in 2025 The Logic of Money Roth, Filing status 2025 magi contribution limit; 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute.

The IRS announced its Roth IRA limits for 2025 Personal, Rules regarding roth ira and married filing. 2025, the contribution limits for an ira are $7,000 for those under age 50 and $8,000 for those 50.

Roth IRA Rules Eligibility, Contributions and Withdrawal Rules for 2025, Here are three new rules retirees need to know about in 2025. Single, head of household and married filing separately (didn’t live with a spouse in.

Roth IRA Contribution Limit 2025 2025 Roth IRA Contribution Limits in, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. Ed slott’s top retirement tax planning opportunities for 2025.

Roth IRA vs 401(k) A Side by Side Comparison, Filing status 2025 magi contribution limit; 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute.